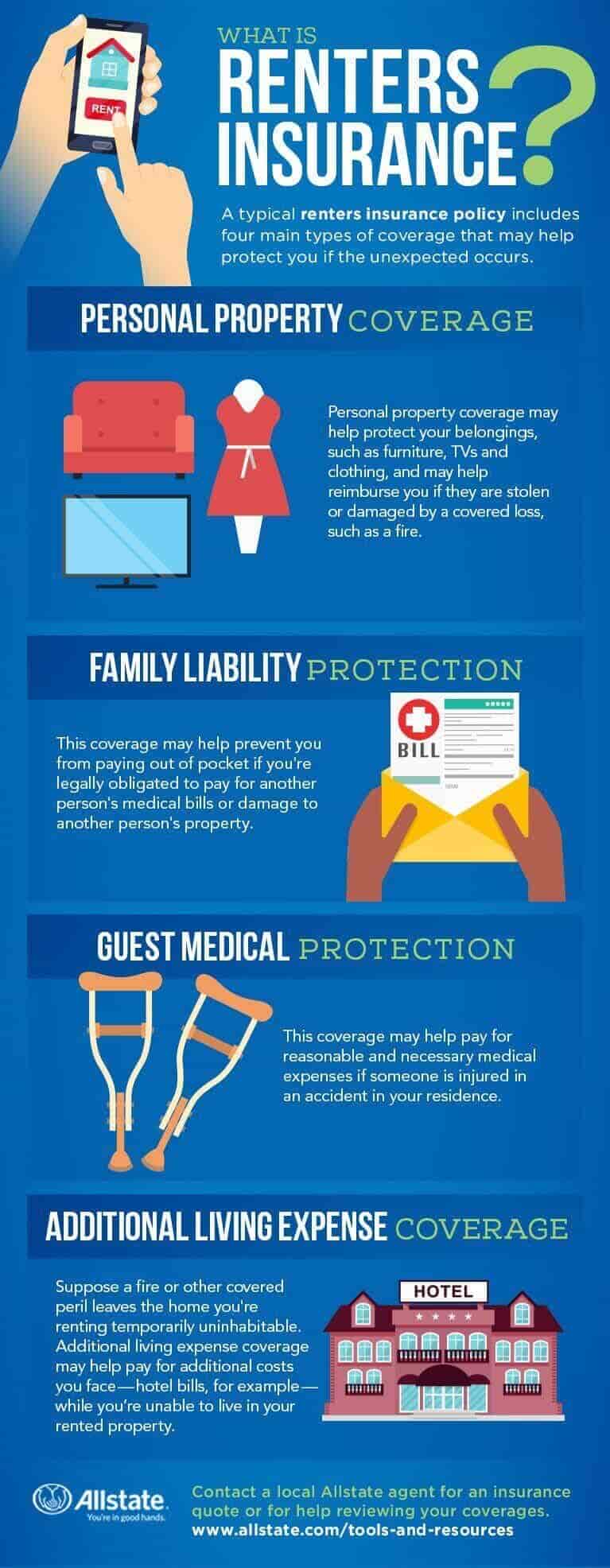

Just How Much Occupants Insurance Should A Proprietor Call For In 2023? A mobile home occupants insurance coverage also provides responsibility insurance coverage. You can be filed a claim against if you inadvertently trigger injuries or eliminate a person. Without occupants insurance coverage, you might be responsible for damages that may ruin you financially. All tenants-- despite the sort of area you reside in-- need to take into consideration purchasing renters insurance. While there are several reasons that occupants pick to lease without insurance, the most usual is that they are ignorant about exactly what occupants insurance policy is and just how it assists them. As a landlord, helping to notify prospective renters regarding what all renters insurance coverage covers will certainly go a long way in searching for or creating a tenant ready to purchase tenants insurance coverage. Landlord insurance coverage can assist you if an occupant accidentally harms the rental unit. For example, your plan could compensate you if a kitchen area fire damages the apartment. Property owner insurance does not cover the occupants' personal property.

Best renters insurance companies of February 2024 - CNN Underscored

Best renters insurance companies of February 2024.

/Who-will-my-auto-insurance-check-claim-be-made-out-to-527131-v2-f4edb97fee6f488d969226528a1b55d0.png)

Posted: Fri, 02 Feb 2024 08:00:00 GMT [source]

Property Owners: Right Here's Why Your Tenants Must Obtain Occupants Insurance Coverage

You ought to however make certain that belongings such as pricey bikes and jewellery are included within the maximum compensation limits. You can check these in our terms and conditions or by calling our customer service. If home insurance policy covers irreversible components of your home in protected events. Irreversible fixtures consist of floor surface areas, wallpaper, cooking area closets and long-term bathroom components, for instance. It is likewise possible to assert payment for moving prices and prices from storage space of movable home during renovation. If home insurance covers movable residential property that breaks all of a sudden and unexpectedly in any kind of situation. Lessee insurance generally safeguards against anybody suing you for problems as much as a specific amount (figured out by the policy you have actually acquired). It will safeguard your valuables, supply liability protection, and may cover your personal things when you travel. Renter's insurance coverage protects you from a lengthy list of dangers, too. Liability insurance coverage is likewise included in conventional occupant's insurance policies.Renters Insurance Policy

If your leasing is unlivable for a while as a result of damages from a fire or a storm, the expense of a short-term resort keep would likely be covered by occupants insurance policy. Your policy needs to cover it, also if your neighbor has a fire and administration has to turn off utilities to your building for a few days to make repairs. It's never ever a bad concept to look for proof of insurance coverage from Learn here brand-new tenants and those renewing their lease. Checking in can work as a tip to renew their plan, and validating your tenants still have renters insurance coverage will certainly let you both remainder simple recognizing the home and their items are covered. Without occupants insurance policy, renters may ask their proprietor to cover their losses.- Without tenants insurance, the lessee may have to birth the financial problem of a loss to their personal property.We also compensate for electrical bicycles and other useful things approximately particular optimum compensation quantities, and, if you desire, we can likewise insure them at their amount.Your property owner's insurance policy covers the structure and the premises, however not your personal belongings.Tenants insurance coverage usually covers damage to your personal effects from a wildfire.Levels of necessity of occupant selection requirements for rental housing in the City of Helsinki to alter 6.9.